The smart Trick of Estate Planning Attorney That Nobody is Discussing

Indicators on Estate Planning Attorney You Should Know

Table of ContentsIndicators on Estate Planning Attorney You Should KnowEstate Planning Attorney Things To Know Before You Get ThisIndicators on Estate Planning Attorney You Should KnowThe Greatest Guide To Estate Planning Attorney

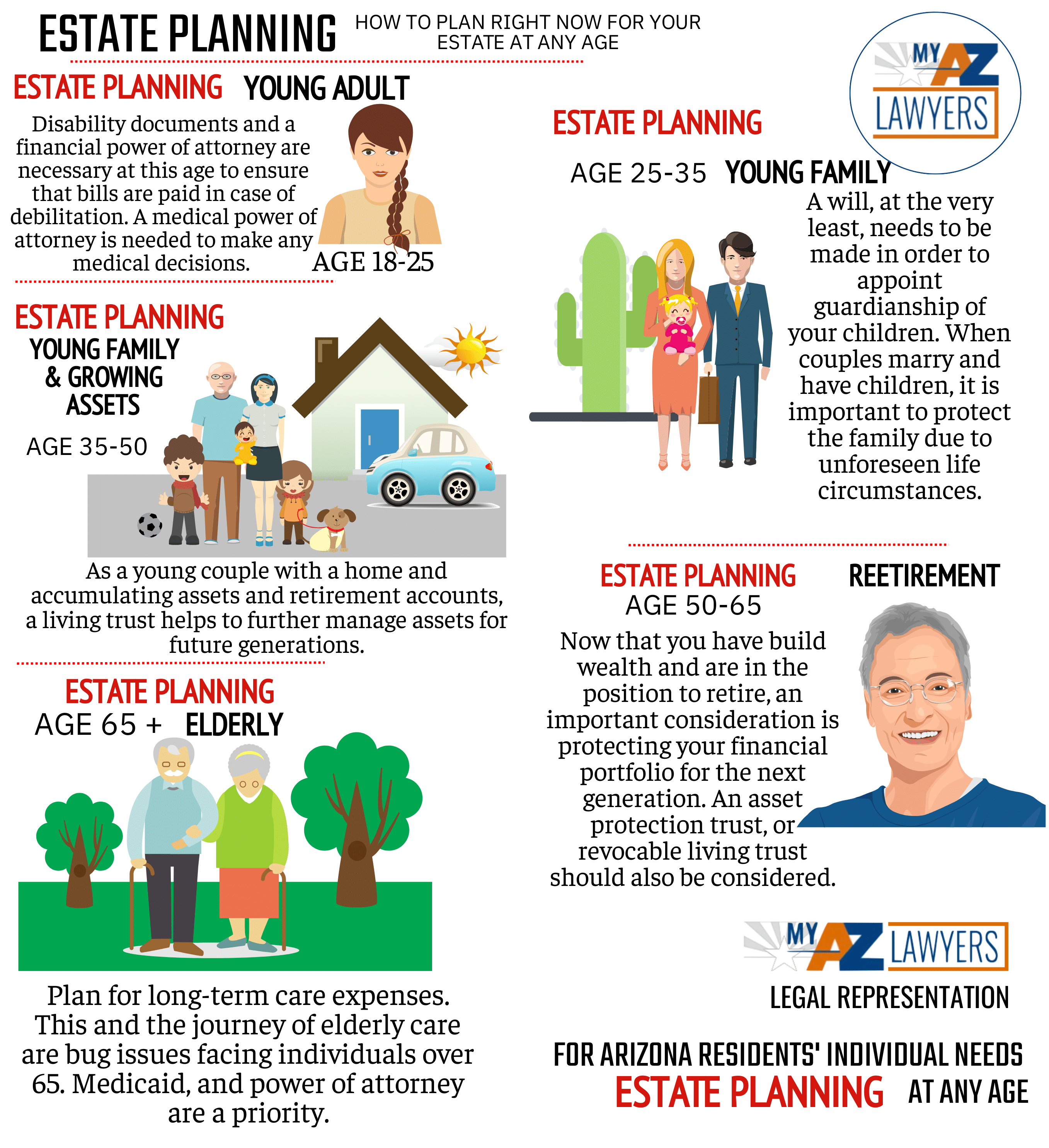

Estate preparation is an action strategy you can make use of to establish what takes place to your assets and commitments while you live and after you pass away. A will, on the various other hand, is a lawful file that lays out how possessions are distributed, who takes treatment of kids and pet dogs, and any type of various other dreams after you pass away.

The administrator likewise needs to settle any kind of tax obligations and debt owed by the deceased from the estate. Lenders typically have a limited amount of time from the day they were alerted of the testator's death to make claims versus the estate for money owed to them. Cases that are declined by the executor can be taken to court where a probate court will have the last say regarding whether or not the insurance claim stands.

Some Ideas on Estate Planning Attorney You Should Know

After the stock of the estate has actually been taken, the worth of assets computed, and taxes and financial obligation repaid, the administrator will after that look for authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will certainly come due within nine months of the day of fatality.

Each specific areas their possessions in the trust fund and names somebody aside from their spouse as the beneficiary. useful reference A-B depends on have actually ended up being much less preferred as the estate tax exception functions well for many estates. Grandparents may transfer properties to an this article entity, such as a 529 plan, to support grandchildrens' education and learning.

The Basic Principles Of Estate Planning Attorney

This method involves freezing the value of a property at its value on the day of transfer. Accordingly, the amount of possible resources gain at fatality is likewise frozen, allowing the estate planner to estimate their potential tax responsibility upon fatality and far better plan for the repayment of revenue tax obligations.

If enough insurance policy earnings are readily available and the plans are correctly structured, any kind of revenue tax on the regarded personalities of properties complying with the fatality of a person can be paid without turning to the sale of assets. Earnings from life insurance policy that are received by the recipients upon the fatality of the guaranteed are generally revenue tax-free.

Other costs linked with estate preparation consist of the preparation of a will, which can be as low as a couple of hundred dollars if you use among the finest online will certainly manufacturers. There are certain papers you'll need as component of the estate preparation process - Estate Planning Attorney. A few of one of the most her comment is here usual ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. Estate planning makes it easier for people to identify their desires prior to and after they pass away.

Little Known Questions About Estate Planning Attorney.

You need to start preparing for your estate as soon as you have any measurable property base. It's an ongoing process: as life progresses, your estate strategy need to shift to match your situations, in line with your new goals. And maintain at it. Not doing your estate planning can trigger unnecessary economic worries to liked ones.

Estate preparation is typically considered a tool for the well-off. Yet that isn't the case. It can be a useful way for you to handle your possessions and responsibilities before and after you die. Estate planning is also a wonderful way for you to outline strategies for the care of your minor children and pet dogs and to detail your want your funeral and favorite charities.

Applications should be. Eligible candidates who pass the test will be officially certified in August. If you're eligible to sit for the examination from a previous application, you may file the short application. According to the regulations, no accreditation will last for a period longer than five years. Discover when your recertification application is due.